What Accounts Receivable AR Are and How Businesses Use Them, with Examples

So far, our discussion of receivables has focused solely on accounts receivable. Companies, however, can expand their business models to include more than one type of receivable. This receivable expansion allows a company to attract a more diverse clientele and increase asset potential to further grow the business. Accounts receivable are an important aspect of a business’s fundamental analysis. Accounts receivable are a current asset, so it measures a company’s liquidity or ability to cover short-term obligations without additional cash flows. Companies classify the promissory notes they hold as notes receivable.

Ace Hardware Reports Second Quarter 2023 Results – Franchising.com

Ace Hardware Reports Second Quarter 2023 Results.

Posted: Thu, 17 Aug 2023 11:57:47 GMT [source]

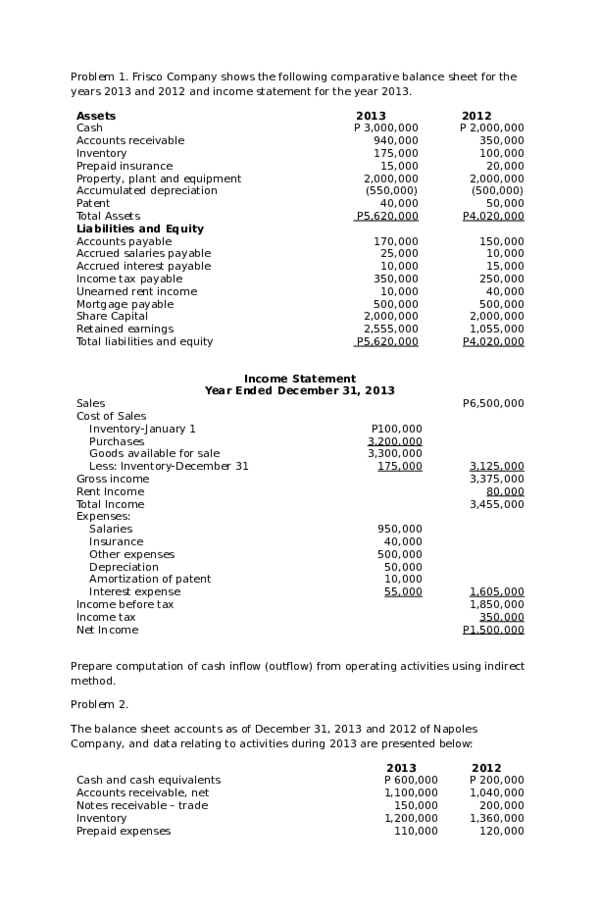

You should classify a note receivable in the balance sheet as a current asset if it is due within 12 months or as non-current (i.e., long-term) if it is due in more than 12 months. Proper management of accounts and notes receivable allows businesses to maintain a healthy cash flow while minimizing potential losses from unpaid debts. Firstly, it’s essential to keep accurate records of all transactions related to accounts and notes receivable. This includes keeping track of payment due dates, amounts owed, and any interest or penalties incurred. Another scenario where accounts receivable comes into play is when your company has recurring revenues from long-term customers who have an established history of timely payments.

Please Sign in to set this content as a favorite.

The amount of any principal or interest payments received on the note will be recorded as cash inflows in the statement of cash flows. Notes receivable are useful asset accounts for businesses to understand. They play a part in increasing collectability of amounts owed, plus they generate revenue in the form of interest. Accounting for notes receivable can be burdensome and error-prone if approached manually.

- Note receivable “makers” — often but not always a customer — get extra time to pay, and note holders receive interest income plus a better likelihood they’ll get paid due to the firmer commitment that a note formalizes.

- We are transitioning the debt from Accounts Receivable to Notes Receivable.

- The note has now been completely paid off, and ABC has recorded a total of $246 in interest income over a three-month period.

- Businesses should have clear policies in place regarding late fees and penalties if payments are not made according to agreed upon terms.

- Notes receivable are used as a financing source for the company and are typically issued to investors who are willing to accept a lower interest rate than they would receive from a bank or other lending institution.

- Accounts payable is an obligation that a business owes to creditors for buying goods or services.

For accounting purposes, a payee records a note receivable as an asset on its balance sheet and the related interest income on its income statement. The portion of the note receivable due to be repaid within one year is classified as a current asset and the balance as a long-term asset. A note receivable is often formed when a business, usually a bank, makes a loan to another business.

However, companies must use the accrual method of accounting and follow some specific rules when recording notes receivable. This can make bookkeeping cumbersome, especially for companies that hold multiple notes receivable. If D. Brown dishonors the note and the company believes the note is a bad debt, allowance for bad debts is debited for $2,500 and notes receivable is credited for $2,500. No interest revenue is recognized because none will ever be received. If a customer signs a promissory note in exchange for merchandise, the entry is recorded by debiting notes receivable and crediting sales. Notes receivable are financial assets of a business which arise when other parties make a documented promise to pay a certain sum on demand or on a specific date.

Accounting for Notes Receivable Accounting Student Guide

The difference between $2,200 and $500 of $1,700 is the factoring expense. Interest revenue from year one had already been recorded in 2018, but the interest revenue from 2019 is not recorded until the end of the note term. Thus, Interest Revenue is increasing (credit) by $200, the remaining revenue earned but not yet recognized. Interest Receivable decreasing (credit) reflects the 2018 interest owed from the customer that is paid to the company at the end of 2019. The second possibility is one entry recognizing principal and interest collection.

This set of journal entries happen every year until the note is completely paid off. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

How is Interest on a Note Recorded?

Notes Receivable is when a company lends money to another person or business with an agreement outlining repayment terms including interest rates and maturity dates. NRs can be long-term debts lasting more than one year and can also include collateral in case the debtor defaults on payment. On 1 May 20X4, PQR, Inc. lent $2 million to ABC, LLC for 2 years against a documented promissory note. DEF, Inc., another client of PQR, Inc. issued a 2-month promissory note against their outstanding balance of $3 million on 1 November 20X4.

- If Sparky’s fiscal year ends during the note receivable term, additional journal entries are required for interest accruals.

- Another opportunity for a company to issue a notes receivable is when one business tries to acquire another.

- Instead of requiring immediate payment upon delivery of goods or services, you allow them to pay at a later date, usually within days after the invoice date.

- Interest income account is credited when the interest received has not been recognized already.

- It will no longer appear on Accounts Receivable reports or be included in the Accounts Receivable total.

- On March 31 a similar entry will be made to record the interest revenue earned in March.

The terms of notes receivable are such that they must be repaid by the borrower at some point in the future, typically within one year. Managing accounts and notes receivable is crucial for any business to ensure cash flow and financial stability. It’s important for businesses to carefully consider their options before deciding whether to use accounts receivable or notes receivable. By analyzing factors such as the size of the transaction and level of risk involved, companies can make informed decisions about which option best suits their needs. Managing accounts receivable is an integral part of any company’s procurement process.

What is a Note Receivable?

Such notes can arise from a variety of circumstances, not the least of which is when credit is extended to a new customer with no formal prior credit history. The maker of the note is the party promising to make payment, the payee is the party to whom payment will be made, the principal is the stated amount of the note, and the maturity date is the day the note will be due. Notes receivable are generally considered to be an asset on a company’s balance sheet. Notes receivable are basically loans that a company has extended to customers, and the company expects to be paid back at some point in the future. Note receivable assets can include both short-term and long-term notes payable. A note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates.

If a customer approaches a lender, requesting $2,000, this amount is the principal. The date on which the security agreement is initially established is the issue date. A note’s maturity date is the date at which What are notes receivable the principal and interest become due and payable. For example, when the previously mentioned customer requested the $2,000 loan on January 1, 2018, terms of repayment included a maturity date of 24 months.

This means that the loan will mature in two years, and the principal and interest are due at that time. The following journal entries occur at the note’s established start date. Examples of notes receivable include employee cash advances with a written promise to pay and uncollected trade accounts receivable (sales owed to a company on credit) converted into promissory notes. Many businesses sell their products or services to customers on credit. They simply send an invoice to the customer after the sale and the customer (theoretically) pays it.

Customers frequently sign promissory notes to settle overdue accounts receivable balances. Brown signs a six‐month, 10%, $2,500 promissory note after falling 90 days past due on her account, the business records the event by debiting notes receivable for $2,500 and crediting accounts receivable from D. Notice that the entry does not include interest revenue, which is not recorded until it is earned. Notes receivable are amounts owed to the company by customers or others who have signed formal promissory notes in acknowledgment of their debts.

What Are Accounts Receivable (AR)?

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. For example, the maker owes $200,000 to the payee at a 10% interest rate, and pays no interest during the first year. Notes receivable usually involve terms such as interest rates, payment schedules and due dates of the loan. They can be secured or unsecured depending on whether collateral is pledged by the borrower in exchange for the loan. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Notes receivable can be secured or unsecured, depending on the borrower’s credit history. A note receivable of $300,000, due in the next 3 months, with payments of $100,000 at the end of each month, and an interest rate of 10%, is recorded for Company A. Like all assets, debits increase notes receivable and credits reduce them. Secondly, timely follow-up with customers who have outstanding balances is critical. Businesses should send out invoices promptly after the sale has been made and follow up with reminders if payments are not made by the due date. This balance represents 89 days [30 days in January, 28 days in February, 31 days in March] of the the 90 day note.

Upstart Announces Second Quarter 2023 Results Upstart Network … – Investor Relations

Upstart Announces Second Quarter 2023 Results Upstart Network ….

Posted: Tue, 08 Aug 2023 07:00:00 GMT [source]

Note receivable from ABC LLC carried 5% simple interest rate payable annually while the one from DEF Inc. carried 8% interest compounded monthly. Additionally, they are classified as current liabilities when the amounts are due within a year. When a note’s maturity is more than one year in the future, it is classified with long-term liabilities.

Deixe uma resposta