Most Undervalued Stocks in India 2023

Content

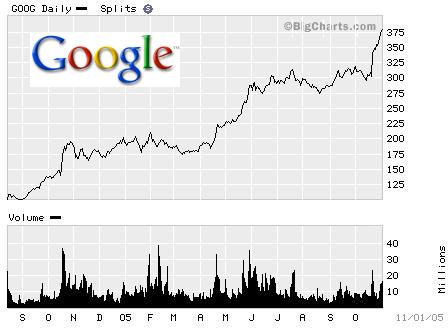

The daily share price chart shows current price action leading the 20, 50 and 100 Simple Moving Averages higher since March 2020. The price consolidation during the first part of 2021 has seen price plateau, and with no real signs of the stock giving up ground, the path of least resistance appears to be upwards. This review will lift the lid on five undervalued stocks in India and outline the tips and tricks to make trading them as safe and rewarding as possible. The company maintains a good debt-equity ratio of 0.51 which is still manageable. The company has the ability to pay its interest multiple times over with an interest coverage ratio of 9.95. The company maintains a good debt-equity ratio of 0.71 which is still manageable.

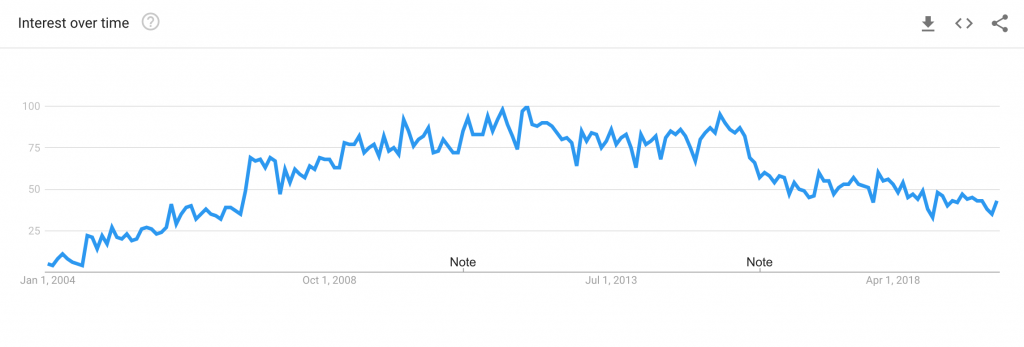

In some situations, when there is a change in the fundamentals of a company, such as a positive change in its management, it won’t always immediately reflect in its stock price. The price/earnings to growth (PEG) ratio establishes a relationship between PE ratio and earnings growth. PEG ratio checks if a company’s share price is undervalued or overvalued by analyzing a company’s current and expected earnings growth rate.

- Despite the broader market rising up, some stocks still appear undervalued.

- Its profit growth over the last 3 years beats its sector leader Sterlite Tech.

- IOL Chemicals and Pharmaceuticals Ltd. is the largest producer of Ibuprofen with a 35% market share.

- The lockdowns in China have affected the selling price of ferro chrome.

- These financials further strengthen Perdoceo’s appeal in the educational sector.

EVgo’s success extends beyond its home market in California, with double-digit utilization achieved in several new markets. The company ended the first quarter with approximately 3,100 stations in operation or under construction, adding nearly 220 new stations during the quarter. EVgo’s customer base also experienced significant growth, undervalued stocks india adding more than 67,000 new customer accounts, bringing the total to approximately 614,000, a 63% increase over the prior year. It is the weighted average of various intrinsic values by different methodologies. It is important for an investor to see which valuation technique best applies depending on the company’s business model.

What are undervalued stocks?

Again coming back to minimizing risk we also consider the debt and the company’s ability to pay the current interest incurred. Now that you’ve understood based on what these stocks have been selected let us take a look at the top undervalued stocks in the country. This vibrant financial performance and an evolving consumer market illustrate the company’s exciting potential for those with an eye on the long-term horizon. Identifying the potential of new companies as well as the underdogs in the industry is another way to find undervalued stocks in India. Look at the companies offering disruptive products and services in the industry or creating a new market or market channel.

No matter you are rich or poor, the market isn’t biased and does not reward and punish accordingly. So before investing in any stocks that are given by the market wizard, do independent research. Our latest destination takes us to the electric vehicle charging sector with EVgo Inc. Recently, the company released its Q report, showing impressive financial growth and significant achievements. Kinross continues to reinforce its standing as a key player in the gold mining industry, demonstrating consistent operational success and financial growth.

Advantages of undervalued stocks

Free cash flow (FCF) is another metric that can be used to check if a stock is undervalued. FCF is the cash that a company generates through its businesses and operations after taking care of the expenditures. PE ratio does not show a company’s future earnings growth hence many consider the PEG ratio as an evolved/modified version of the PE ratio. Hence, if the PEG ratio of a company is low, it is probably one of the undervalued growth stocks in India. Sometimes, bad news can lead to stocks becoming undervalued for a short period even though their financial fundamentals remain strong. This plant is one of the largest in India in terms of production capacity.

Assuming that the leasing company owns 10,000 cars, each valued at Rs. 10 lakh, its total assets would be worth Rs. 1000 crore. And at 20%, the annual depreciation of its assets will be Rs. 200 crore. Undervalued stocks in India are a great opportunity to make strategic investments with big returns. Good and bad news both affect the stock market by changing the public’s perception of a company. In August and September, the stock printed at prices last seen in 2008. This bullish price signal followed a 20-month bull run and a breakout of a +10-year trading range.

Dirt-Cheap Stocks to Buy: Teladoc (TDOC)

Part of the reason why companies have started to take cybersecurity extremely seriously is pressure from governments, regulators and investors. The SEC published some rules in this regard back in 2022 which the body is expected to finalize in the coming months. The SEC wants company board members to have expertise and clear policies regarding cybersecurity and how to protect company and investor assets from cyber attacks. So in this blog, we will be talking about such fundamentally strong undervalued stocks and where you can find them.

The Company has also diversified its business in Micro-Finance, Vehicle Loans, and MSMEs. Mr. Amitabh Chaudhry joined Axis Bank as MD and CEO in January 2019, after heading HDFC Life for nine years. He brought in new hunger within the bank and had a two-eyed focus both on growth and asset quality issues. Although the stock has given a return of ~3.7% in the last 3 years, there is a lot of potential underlying in the stock. IOL Chemicals and Pharmaceuticals Ltd. is the largest producer of Ibuprofen with a 35% market share.

Who should invest in undervalued shares?

One industry that’s certainly positioned to benefit is travel and tourism. The company demerged a small part of its business in the financial year 2018. The industry is also overcrowded, making it difficult for companies to maintain high margins. The company manufactures premium quality compact and elitwist cotton yarn used in hosiery and weaving. It is an established textile player in the international and domestic yarn market, with exports constituting over 60% of its revenues.

- The firm’s liquidity to meet its immediate needs is slightly low with a current ratio of 0.77.

- The company transfers these gasses to the plant through its own distribution networks, where these gasses are transformed into renewable natural gas that is subsequently distributed to its customers.

- Sales and profits have nearly doubled, and their 5-year CAGR comes in at 10.6% and 21.7%%, respectively.

The stock price mirrors this performance, having doubled in the last five years. The undervaluation could be due to poor performance in the quarter ending September 2022. While sales have grown at a CAGR of 11.7% in five years, net profit has grown by 9.6%. The stock currently trades at a PE multiple of 1.01 times, a discount of 28% to its 10-year median PE of 1.3 times. However, many investors often fail to realise that the most important thing to analyse in smallcaps is their underlying business. As attractive as smaller undervalued companies may seem, you must understand that the prospect of outsized returns comes in tandem with high volatility.

The company’s stock price is up 45 per cent since the beginning of the year, mainly led by the demand uptick in the auto segment. The dominant position has allowed the business to perform well over the past few years. The sales has grown at a 5-year CAGR of 8.4 per cent while net profit has grown at a CAGR of 33.7 per cent respectively. It competes in the domestic and global markets and caters to the food, pharmaceutical, and feed industries.

How have we looked for undervalued stocks?

For instance, smaller companies not on the radar of analysts and investors may be experiencing a growth in sales and profit, but it may not be reflected by an increase in their share prices. Increased interest from those ‘buy-and-hold’ investors will offer long-term support to the share price. Value investing is a strategy which consists of cherry picking those stocks that has their current value much lesser than the intrinsic value. But if the company has potential to grow, then the current investment is cheaper as the market price will eventually rise and meet its intrinsic value.

These industries include healthcare, financial, and pharmaceutical industries. In this article, we will take a look at the 10 most undervalued cybersecurity stocks to buy according to hedge funds. To see more such companies, go directly to 5 Most Undervalued Cybersecurity Stocks To Buy According To Hedge Funds. Sportking India share price has taken a beating, falling by 46% since February 2022. This comes on the back of a dip in profitability in the past few quarters.

Paushak Limited

It was pioneered by Benjamin Graham and later followed by his student and protégé Warren Buffet. Long-term investors need to be aware of the benefits of stop-loss and take profit instructions, but buy-and-hold investors often avoid using them. The view taken is that a short-term price crash could kick them out of a position that would ultimately come good. Take profit orders will lock in gains but cap potential upside when a stock finally gets going.

Deixe uma resposta